Volume Analysis in Crypto Trading Techniques

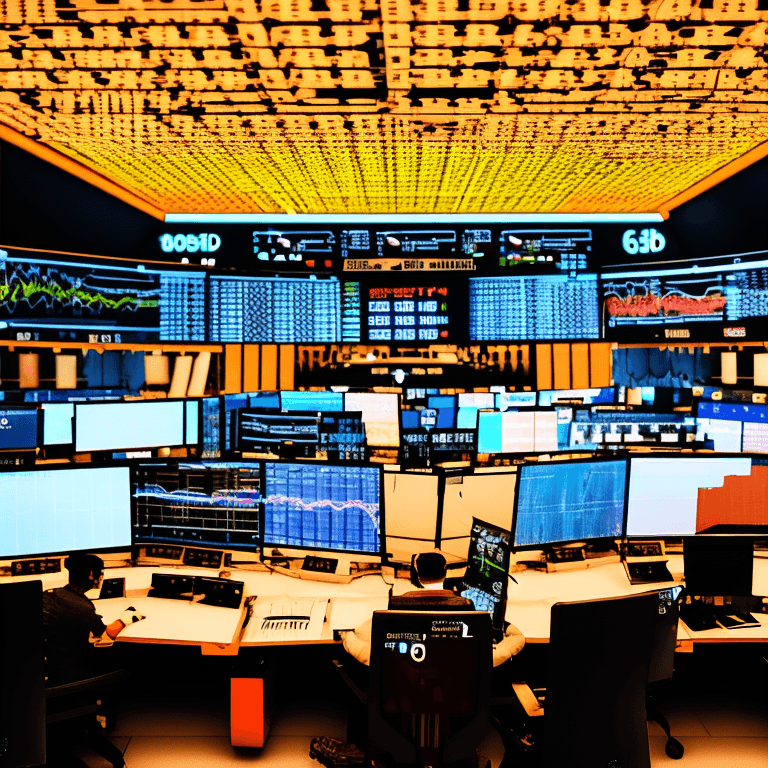

Cryptocurrency trading has emerged as a popular investment avenue, attracting traders from all over the world. As the crypto market continues to evolve, traders are constantly seeking ways to gain an edge and make profitable trades. One such technique that has gained significant attention is volume analysis in crypto trading. By examining trading volume, traders can gain valuable insights into market dynamics, identify trends, and make informed trading decisions. In this article, we will delve into the intricacies of volume analysis in crypto trading techniques, exploring its importance, popular methods, and practical tips to incorporate this analysis into your trading strategy.

Understanding Volume Analysis

Before we delve into the techniques and strategies, it's essential to understand what volume analysis entails in the context of crypto trading. Volume refers to the total number of shares or contracts traded within a specified timeframe. In the world of cryptocurrencies, volume represents the number of tokens or coins traded over a particular period. Volume analysis involves studying these trading volumes to identify patterns, trends, and potential market movements.

The Importance of Volume Analysis

Volume analysis holds significant importance in crypto trading for several reasons:

Identifying Liquidity: Examining trading volume helps traders determine the liquidity of a particular cryptocurrency. Higher trading volumes indicate greater liquidity, making it easier to buy or sell a particular asset without significantly impacting its price.

Confirmation of Price Movements: Volume analysis can serve as a confirmation tool for price movements. When prices rise or fall accompanied by high trading volumes, it suggests a strong market consensus, increasing the likelihood of a sustained trend.

Identifying Reversals: Sudden shifts in trading volume can indicate potential reversals in the market. Volume analysis helps traders identify periods of accumulation or distribution, providing insights into market sentiment and potential changes in trend direction.

Spotting Breakouts and Breakdowns: Monitoring trading volume can help identify breakouts or breakdowns, where prices move above or below significant support or resistance levels. Higher volumes during these price movements can confirm the strength of the breakout or breakdown.

Popular Volume Analysis Techniques

Several techniques can be employed to conduct volume analysis in crypto trading. Let's explore some of the widely used methods:

1. Volume Bars

Volume bars are a common way to visualize trading volume on price charts. They represent the volume of trading activity for a specific period, often displayed as vertical bars on the chart. Traders can quickly assess the intensity of trading activity and identify periods of high or low volume.

2. On-Balance Volume (OBV)

On-Balance Volume (OBV) is a technical indicator used to track cumulative buying and selling pressure. By comparing the OBV line with price movements, traders can identify divergences and potential trend reversals.

3. Volume Profile

Volume Profile provides a visual representation of the trading volume at various price levels. It helps traders identify significant support and resistance zones, as well as areas of high trading interest.

4. Moving Average Volume

Moving Average Volume is calculated by applying a moving average to the trading volume data. It smooths out the volume fluctuations and helps traders identify trends and potential breakouts.

5. Accumulation/Distribution

The Accumulation/Distribution indicator measures the buying and selling pressure in the market. It considers both price and volume data to provide insights into the strength of a particular trend.

6. Chaikin Money Flow (CMF)

Chaikin Money Flow (CMF) is an oscillator that combines price and volume data to assess the flow of money in and out of a cryptocurrency. Traders use CMF to identify potential buying or selling opportunities.

Incorporating Volume Analysis into Your Trading Strategy

Now that we have explored some popular volume analysis techniques, let's discuss how you can effectively incorporate volume analysis into your crypto trading strategy. Consider the following tips:

1. Combine Volume Analysis with Price Analysis

To gain a comprehensive understanding of the market, it's crucial to combine volume analysis with price analysis. By examining both volume and price movements, you can identify potential entry and exit points with greater confidence.

2. Look for Volume Spikes

Pay close attention to volume spikes, as they often indicate significant market movements. When volume increases abruptly, it suggests increased market activity and potential trading opportunities.

3. Analyze Volume Patterns

Identify recurring volume patterns and observe how they correlate with price movements. Certain volume patterns, such as expanding volume during uptrends or decreasing volume during consolidations, can provide valuable insights into market sentiment.

4. Consider Multiple Timeframes

Analyze volume across multiple timeframes to get a comprehensive view of the market. Higher volumes on longer timeframes can confirm the validity of trends observed on shorter timeframes.

5. Monitor Volume Divergence

Volume divergence occurs when the price moves in one direction while the volume moves in the opposite direction. This can signal a potential trend reversal or weakening momentum, providing valuable insights for traders.

6. Practice Risk Management

While volume analysis can be a powerful tool, it is essential to practice proper risk management in your trading strategy. Set stop-loss orders, determine risk-to-reward ratios, and manage your position sizes to protect your capital.

FAQs

Q1: Why is volume analysis important in crypto trading? Volume analysis is important in crypto trading as it helps traders identify liquidity, confirm price movements, spot reversals, and identify breakouts or breakdowns.

Q2: What are some popular volume analysis techniques in crypto trading? Some popular volume analysis techniques in crypto trading include volume bars, on-balance volume (OBV), volume profile, moving average volume, accumulation/distribution, and Chaikin Money Flow (CMF).

Q3: How can I incorporate volume analysis into my trading strategy? You can incorporate volume analysis into your trading strategy by combining it with price analysis, looking for volume spikes, analyzing volume patterns, considering multiple timeframes, monitoring volume divergence, and practicing risk management.

Q4: Can volume analysis be used for day trading as well as long-term trading? Yes, volume analysis can be utilized in both day trading and long-term trading strategies. It provides valuable insights into market dynamics and helps traders make informed decisions.

Q5: Is volume analysis the sole determinant of a trading decision? No, volume analysis should be used in conjunction with other technical and fundamental analysis tools. It is one of the factors to consider when making trading decisions, but not the sole determinant.

Q6: How often should I analyze volume in crypto trading? It is recommended to analyze volume regularly, as it provides valuable insights into market trends and sentiment. Incorporate volume analysis into your routine technical analysis to stay informed about market dynamics.

Conclusion

Volume analysis in crypto trading techniques plays a crucial role in helping traders gain valuable insights into market dynamics, identify trends, and make informed trading decisions. By examining trading volumes and utilizing popular volume analysis techniques, traders can enhance their understanding of the market and improve their trading strategies. Remember to combine volume analysis with other technical and fundamental analysis tools, practice risk management, and stay consistent in analyzing volume to make the most out of this powerful analysis technique. So dive into the world of volume analysis and unlock new possibilities in your crypto trading journey.

Experts and Support

Gain insights, receive mentorship, engage in discussions, expand your network, and enhance your learning journey. Join our Telegram group for expert guidance and support! Don't miss out!

Also discover a treasure trove of valuable information by exploring our website's search feature. Whether you're seeking answers to burning questions or in-depth insights on a specific topic, our website's search functionality is your gateway to a wealth of knowledge. Unleash the power of search and unlock a world of information at your fingertips. Simply type in your query and embark on a journey of discovery, where every search leads to new insights, empowering you with the knowledge you seek. Don't wait any longer—dive into our website's search and uncover a wealth of information that awaits you.

If you're interested in keeping track of crypto price movements, there are many different tools and resources available to help you stay informed. Our in-house indicator is a great option for those who want access to reliable and accurate information on Bitcoin's price. It's a simple and hassle-free way to keep track of Bitcoin's price movements without having to spend a lot of time and effort on research. So if you're looking for a convenient and effective way to stay informed about Bitcoin, be sure to check out our in-house indicator today.