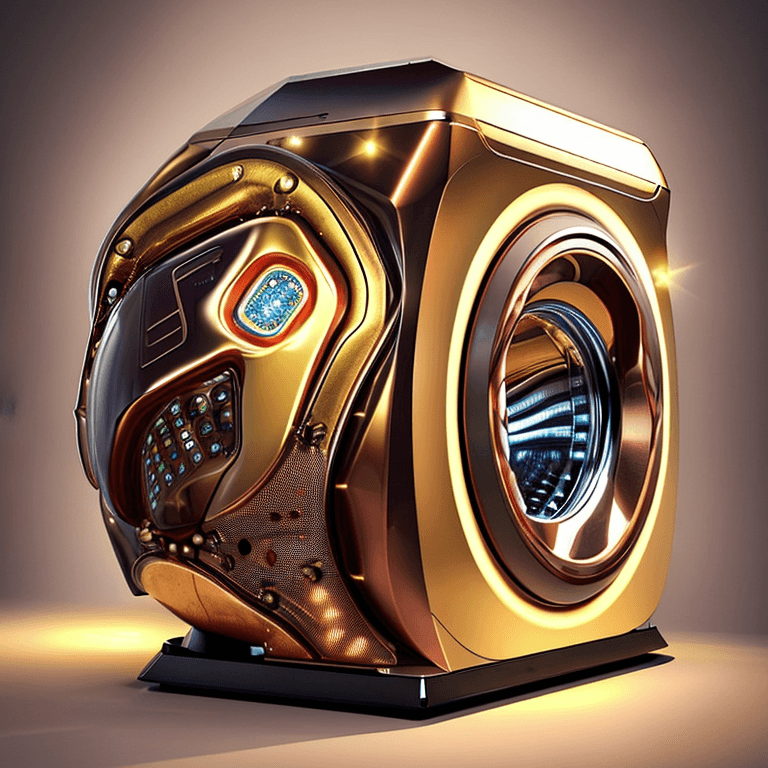

The $358M Crypto washing machine

The crypto market has taken a beating, causing over $358 million in liquidations, as Bitcoin and Ether experience a significant decline. The CoinDesk Market Index, which measures the overall performance of the cryptocurrency market, has also taken a hit.

The sudden drop in the crypto market has resulted in losses for long positions and short positions, leading to liquidations across the board. Many investors have been caught off guard by the market's recent volatility, with cautious investors looking for stability and long-term returns.

Reasons for the Market Drop

There are several reasons for the recent market drop, including the actions of Jump Trading, a major player in the cryptocurrency market. According to blockchain analysis, Jump Trading has been selling large amounts of Bitcoin and Ether, which has put pressure on the market and caused prices to fall.

There are also rumors of a large sell intention from a whale investor, which has further contributed to the decline in the market. The combination of these factors has led to a bear market, with many investors struggling to navigate the current landscape.

Investment Strategies in a Volatile Market

Investors like Jenny Johnson of Franklin Templeton have been actively seeking out crypto-linked investment opportunities, despite the recent market turmoil. Johnson believes that the long-term potential of the cryptocurrency market outweighs the risks associated with short-term volatility.

However, many investors are understandably cautious, given the current state of the market. It is important to approach crypto investments with a long-term perspective, as the market is still relatively young and unpredictable.

Institutional Investors and the Future of Crypto

Institutional investors have been increasingly interested in the cryptocurrency market, but the recent market drop has highlighted the risks associated with investing in digital assets. While some institutions have been actively buying Bitcoin and other cryptocurrencies, others have been more cautious, waiting for more stability in the market before making any significant investments.

The future of crypto will depend on a variety of factors, including government regulation, mainstream adoption, and technological innovation. Despite the recent market drop, many experts believe that the long-term potential of the cryptocurrency market is still significant.