The Untold Truth about First Republic Bank

First Republic Bank has experienced significant growth since its founding in 1985. As of the latest available data, the bank has total assets of over $200 billion, making it one of the largest banks in the United States. With a network of branches across major cities in the U.S., including San Francisco, Los Angeles, New York City, and Boston, First Republic Bank serves a wide range of clients, including high net worth individuals, businesses, and professionals.

What is the ranking of First Republic Bank?

First Republic Bank has consistently been ranked highly in various industry rankings and awards. As of 2023, the bank has received numerous accolades for its exceptional customer service, wealth management capabilities, and overall financial performance. Some of the recent rankings and awards received by First Republic Bank include:

Ranked #1 in Forbes' America's Best Banks for the tenth consecutive year.

Recognised as one of the Best Banks in America by MONEY Magazine.

Awarded Best Private Bank in North America by Private Banker International.

These rankings highlight First Republic Bank's reputation as a top-performing bank in the industry, known for its exceptional service and financial expertise.

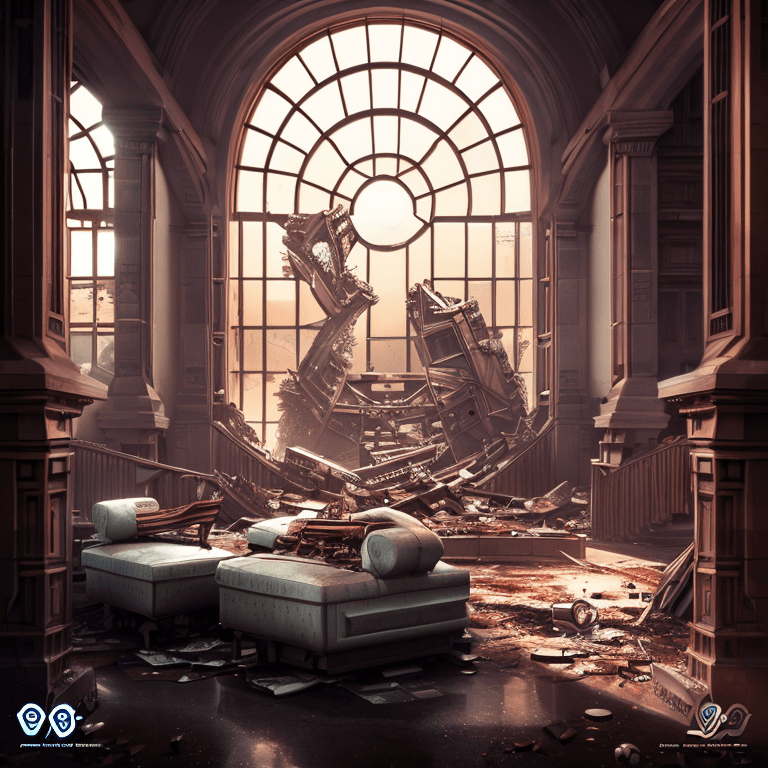

Why is First Republic Bank collapsing?

Recent developments in the banking industry have raised concerns about the stability of First Republic Bank. While the bank has enjoyed a strong reputation and growth in recent years, there have been speculations about potential challenges that could impact its stability, leading to questions about whether First Republic Bank is at risk of collapsing.

There are several reasons that have been suggested as potential factors contributing to the concerns about the stability of First Republic Bank:

Economic Uncertainty: The global economic landscape is constantly changing, and uncertainties in the economy can impact the financial performance of banks, including First Republic Bank. Economic downturns, market volatility, and changes in interest rates can all impact the bank's profitability and stability.

Regulatory Changes: The banking industry is highly regulated, and changes in regulations can impact the operations and profitability of banks. Changes in regulatory requirements, compliance costs, and increased scrutiny from regulators can all pose challenges for First Republic Bank.

Competitive Landscape: The banking industry is highly competitive, with numerous players vying for market share. Increased competition, especially from new digital and fintech players, can impact First Republic Bank's customer base, profitability, and overall stability.

Loan Quality: First Republic Bank, like any other bank, faces risks associated with its loan portfolio. A significant increase in loan defaults or a deterioration in the quality of loans can impact the bank's financial performance and stability.

Leadership Changes: Changes in leadership, including key executive departures or a lack of effective leadership, can impact the strategic direction and operations of First Republic Bank, potentially affecting its stability.

External Events: External events, such as geopolitical tensions, natural disasters, or unforeseen events like a global pandemic, can have a significant impact on the financial industry and potentially impact the stability of banks like First Republic Bank.

Insufficient liquidity and high exposure to risk can occur in financial markets when there is a misoperation or error or even taking on excessive leverage or relying heavily on speculative positions, can amplify the impact of misoperations or errors, increasing the likelihood of a collapse in the financial markets.

Inverse Jim Cramer indicator.

Traditional Financial system is collapsing. Stay safe buy ledger.