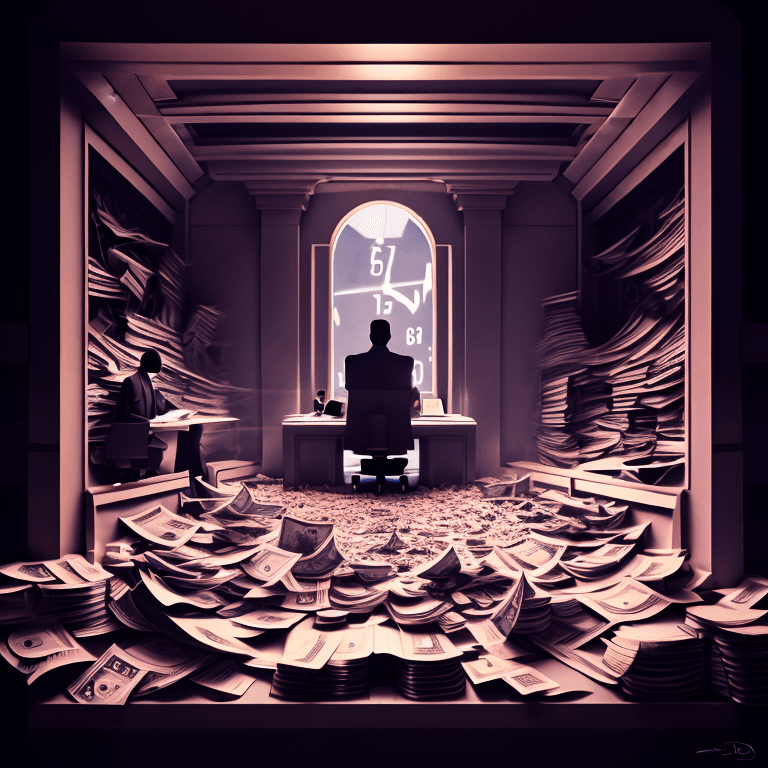

Crypto's Rise Amidst Debt Ceiling and USD Reserve Status Concerns

At present, the global economy is facing a complex set of challenges that require careful analysis and strategic action. In this article, we will examine three interrelated issues that are shaping the future of finance and investment: the debt ceiling, the status of the US dollar as a reserve currency, and the growing liquidity of cryptocurrency markets. We will discuss the implications of these trends for investors and businesses, and provide some recommendations for adapting to the changing landscape of global finance.

Debt Ceiling: What is it and why does it matter?

The debt ceiling is the legal limit on the amount of money that the US government can borrow to fund its operations. It is set by Congress and has been raised many times in the past to accommodate increasing levels of debt. However, in recent years, the debt ceiling has become a contentious political issue, with some lawmakers refusing to raise it without significant concessions from the opposing party.

The implications of failing to raise the debt ceiling could be severe, including a government shutdown, default on debt obligations, and a loss of confidence in the US economy. Investors and businesses should monitor developments closely and prepare for potential disruptions to financial markets.

USD Losing Reserve Currency Status

For decades, the US dollar has been the dominant reserve currency in the world, meaning that many countries hold large amounts of US dollars as a store of value and a medium of exchange. However, in recent years, there has been growing speculation that the US dollar's status as a reserve currency may be in jeopardy.

There are several factors driving this trend, including the rise of other major economies such as China and the Eurozone, the increasing use of alternative payment systems such as cryptocurrencies, and concerns about the long-term stability of the US economy and political system.

If the US dollar were to lose its reserve currency status, it could have significant implications for the global financial system, including higher borrowing costs for the US government and a potential shift towards alternative currencies such as the Chinese yuan or the Euro.

While USD Falls Crypto Grows Liquidity

Cryptocurrency markets have seen explosive growth and this growth has been driven by a variety of factors, including increased institutional adoption, improved regulatory clarity, and a growing recognition of the potential benefits of blockchain technology.

One of the important aspects that drive liquidity to cryptocurrency is falling US dollar. People may turn to cryptocurrency as an alternative store of value and investment. This is because cryptocurrencies are decentralized and not subject to the same economic and political forces that can impact traditional currencies. Additionally, some investors see cryptocurrencies as a hedge against inflation and market volatility.

Another key trend in the cryptocurrency market is the growing liquidity of digital assets, which refers to the ease with which they can be bought and sold on exchanges. This liquidity has made it easier for investors to trade cryptocurrencies and has helped to increase their acceptance as a legitimate asset class.

However, the growing liquidity of cryptocurrency markets also presents new risks and challenges for investors and businesses. For example, it can lead to greater volatility in prices, increased regulatory scrutiny, and a greater risk of fraud and hacking.